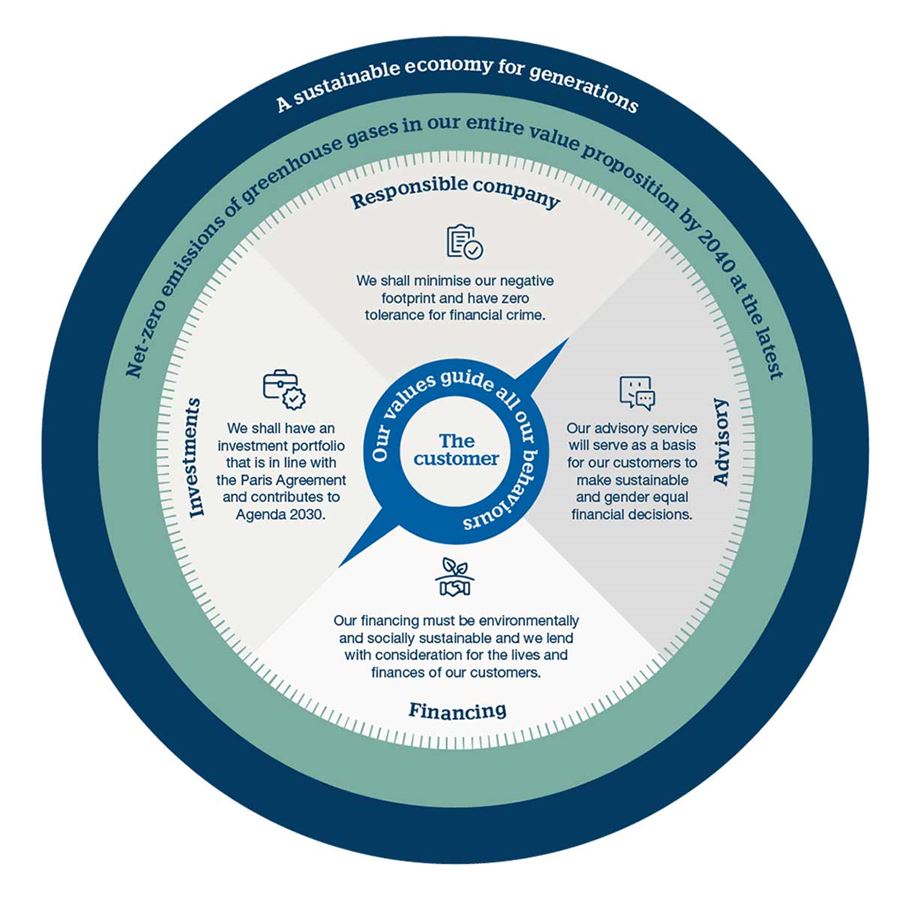

Handelsbanken’s way of banking is based on trust and respect for the individual. Connecting with customers is central to this – the Bank aims to support its customers through all stages of their lives, basing its business on their needs and preferences. Handelsbanken’s sustainability strategy, like many other aspects of the Bank’s work, is applied through a decentralised way of working, characterised by a focus on low risks and with a long-term commitment to its customers. The Bank has identified a growing demand for products and services that not only concern economy and finance, but also support the transition to a sustainable society. Consequently, Handelsbanken’s business operations are to be characterised by long-term responsibility, from financing and savings to investments and advisory services. For Handelsbanken, the concept of “responsibility” in this respect refers to solutions that, over time, benefit people, society and the planet.

Direct and indirect engagement

A well-run bank that acts sustainably and responsibly has a positive impact on the economy in general. This applies to direct economic effects, such as paying corporate tax, as well as indirect effects. For example, the conditions under which the Bank lends money can make a huge difference, to both the individual and society. In all markets it serves, Handelsbanken finances growth and helps increase employment by providing financing for companies. For example, Handelsbanken is the largest corporate lender in Sweden, and more than one-fifth of household mortgages in Sweden are financed by the Handelsbanken Group.

Banking operations in themselves have a relatively minor direct impact on the environment and climate, but striving to constantly reduce the Bank’s own impact remains important. Looking for ways to improve energy efficiency, reducing paper consumption and cutting back on travel by air and car – focusing instead on solutions for remote meetings – help to reduce the Bank’s direct negative impact. Digital solutions also help the Bank and customers to reduce their respective climate footprints. A sustainable society requires a robust financial system that cannot be abused. For this reason, the fight against money laundering and terrorist financing is a key component of the 2030 Agenda and the SDGs. Handelsbanken regards work to prevent financial crime as a fundamental principle for secure, sound banking operations.

Customer-centric approach

Handelsbanken’s greatest impact on sustainable development, whether in a positive or negative direction, lies in its business operations: through financing customers’ projects and businesses, and being entrusted to manage customers’ assets. On issues such as the climate, environment, biodiversity, human rights and inclusivity, the Bank has the greatest chance to make a positive difference by supporting customers through their sustainable transition. By helping our customers – whether large companies, SMEs or private customers – to be more sustainable, Handelsbanken itself becomes more sustainable. Handelsbanken thus works actively to support and accelerate its customers’ sustainable development. This takes the form of dialogue and advice, within the framework of financing, in discussions regarding savings and by building close relationships with customers.

Approach to risk

Financial strength and stability help Handelsbanken to avoid becoming a burden on society. Handelsbanken has a low risk tolerance, which has helped the Bank keep its credit losses at a low level. Instead, the Bank can positively contribute by being a responsible taxpayer and contributing to financial stability under all economic conditions. Handelsbanken considers the prevention of direct and indirect risks as part of its sustainability work. The Bank is well aware that social and environmental matters can significantly increase credit risk, investment risk and reputational risk. Sustainability risks are thus integrated into normal processes and procedures.